This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

When markets innovate, regulations ensue. In the automotive industry, this is inevitable, with safety, reliability, and quality as core concerns. Following a 40% increase in electric vehicle sales in Europe, policymakers are set to introduce a wave of legislation surrounding their use.

For specialist vehicles, where the demands are joined by market regulations of their own, there are safety policies being reviewed by the ACEA that will affect the requirements of EVs. To help, Dalroad has compiled some context on the EU’s history with EV regulations, and how they will affect the future of the automotive industry across the continent.

The EU’s stance

The EU has taken a leading stance on electric vehicle legislation. This has influenced the way members (and soon to be non-members, like the UK) approach EV policymaking.

An EU directive, following the Clean Power for Transport package, was written to encourage the use of alternative fuels and the development of wide-reaching recharging infrastructure.

The following were listed as requirements:

- Member states are to develop national policy frameworks for the market development of alternative fuels and their infrastructure;

- The increased use of a set of common technical specifications for recharging and fuelling stations;

- The development of appropriate customer information on alternative fuels, including a clear and sound price comparison methodology.

These requirements have informed the targets set by the EU, with each country given two years to submit their national policy frameworks. The aim is to ensure coherence between member states.

What policies have been put forward?

The European Green Vehicles Initiative, one of three Public Private Partnerships included in the 2008 European Economic Recovery Plan, is an ongoing initiative set up to boost the automotive industry; encouraging the development of new sustainable forms of road transport (primarily electric vehicles).

The EU has generally taken zero-emission road transport seriously; a move they have coined ‘tank-to-wheels’. Policy related to battery-powered vehicles have listed ‘growing technical optimisation and market development’ as their target.

The EU, however, has not been able to compete with China in these fields – growing concerns over the future of EV engineering in the EU.

No-emission deadlines continue to influence policy making

With many EU member states setting end dates for the sale of fossil fuel powered vehicles (2050, as set by the ACEA) emission targets have toughened, while China, the USA, and Europe race to make EVs a viable option for consumers and businesses alike. Norway – not a member state – was the highest purchaser of electric vehicles in the continent, making up one-fifth of all European adoption.

Policies will boost battery manufacture in Europe

The EU is not only proposing how to boost technical optimisation to supplement an all-electric continent.

The Horizon 2020 research fund, described by the EU as their ‘biggest research and Innovation program ever’, has set aside money to invest in electric battery plants – aptly named ‘the battery alliance’. According to the Financial Times, it offers five kinds of funding:

“Individual EU countries will be allowed to fund 100% of research, as long as they involve some cross-border projects. The EU’s Horizon 2020 research fund has set aside €200 million for battery projects; €800 million is available to finance building demonstration facilities; regions looking to promote the industry can apply for the €22 billion regional funds available; and the European Fund for Strategic Investment is available from the European Investment Bank.”

The ACEA plans to improve safety for commercial vehicles

The European Automobile Manufacturer Association (ACEA), has been leading the way for safety standards in specialist vehicles. Since 2001, the number of fatalities involving heavy goods vehicles declined by more than 42% – the ACEA claims this is due to regulations such as the requirement for ABS, EBS, and other systems; systems further enhanced by the Electronic Stability Control Programme (ESP).

In May 2018, a revision to the EU’s General Safety Regulation was considered, which specifies the safety systems new specialist vehicles should come with as standard. This was jointly at the wishes of the ACEA, and the specialist truck industry who believe that proposed measures require further review. You can read the details here.

A new act in the UK is set to revolutionise EV safety and maintenance

On the heels of the Brexit vote, follows the UK’s own efforts to write EV legislation. As part of the country’s own national policy framework, in July 2018, new legislation was passed in the UK which has enshrined the requirements for electric vehicle charging into law: The ‘Automated and Electric Vehicles Act’.

Part 2, entitled ‘Electric Vehicle Charging’, confirms the obvious definitions, with the terms ‘charging / public charging point’ now accepted as part of the legal vernacular.

What will be interesting to follow, however, is Section 10 – Performance and Standards – which is more closely linked to maintenance schedules and safety standards. This will also prevent manufacturers from building exclusive components for their charging points. Instead, the regulation encourages manufacturers to adopt well-supported charging standards.

The AEV Act will also encourage more electric vehicle charging infrastructure across the country, including at UK motorway services. As with Commercial Truck petrol stations, will we see areas exclusively for Commercial EV?

You can read the details here.

Road to Zero strategy to keep electric car charging costs down

The UK government’s Road to Zero Strategy has decreed that from July 2019, government-funded charge-points for electric vehicles must use innovative “smart”, connected technology.

Charge-points must be remotely accessible and capable of receiving, interpreting and reacting to a wireless signal. It is expected that this will reduce high peaks of electricity demands, and keep charging costs down by encouraging off-peak charging.

In response, Automotive Minister Richard Harrington said: “Through our strategy… we are investing to ensure the UK leads in innovation and manufacture of electric vehicle batteries and technologies’. It is not yet sure how this strategy will work with EU regulation.

What’s next?

As with all changes in regulation, both challenges and opportunities are set to arise.

This is an exciting time to be designing specialist vehicles. Further investment from the EU and UK will breed innovation; while the cost-benefits of using EVs are more prevalent than ever.

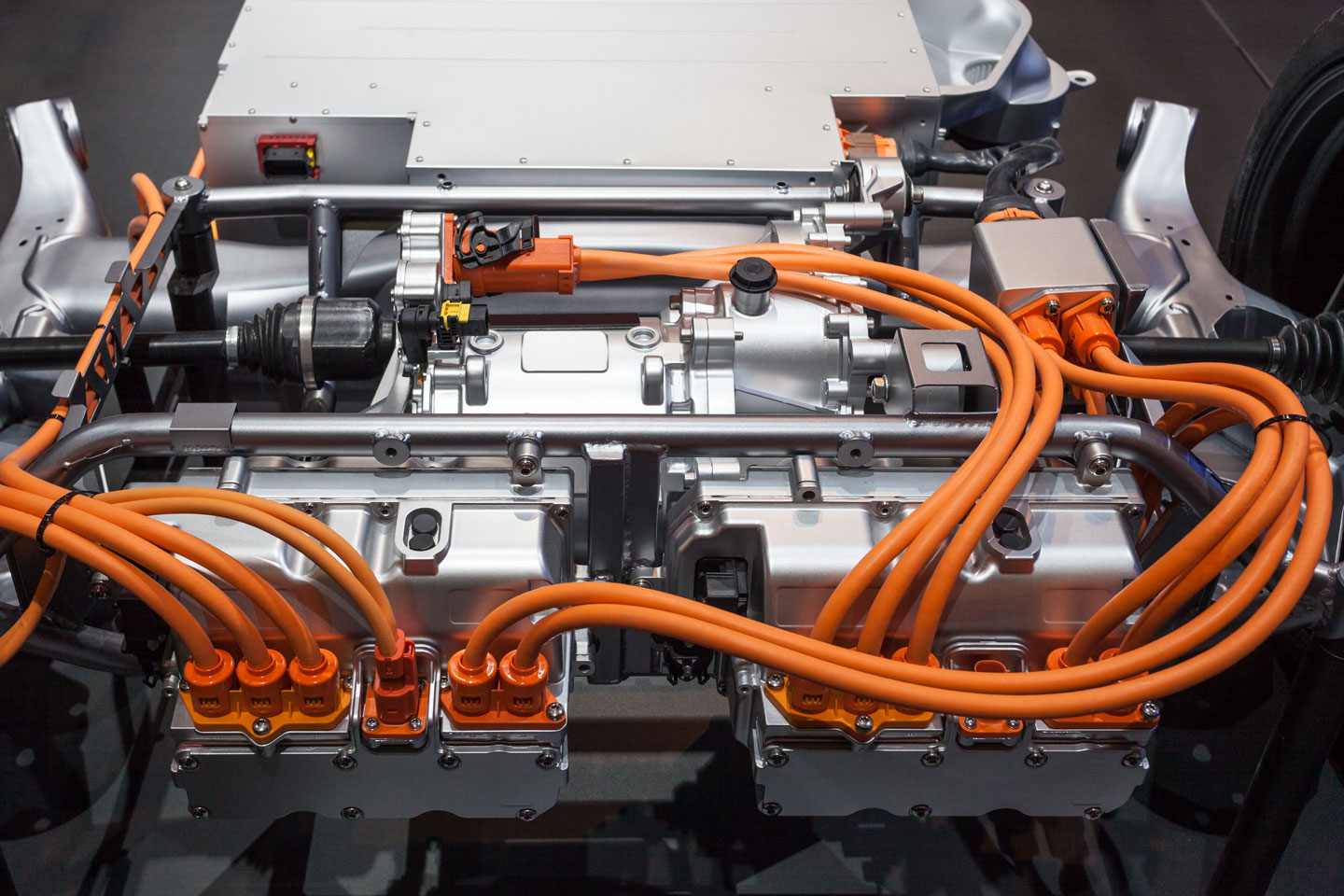

The move to electrification has been complemented by new, high-quality components, built to ensure safety and robustness for each vehicle. If you are working on an active EV project and are seeking components to help you meet existing and incoming regulations, get in touch with our EV experts at Dalroad.

Dalroad has built a network of trusted specialists who continue to innovate and manufacture high-performance components. With our expertise and guidance, our teams will inform your designs with the best parts, and ensure that they pass any current, or proposed regulatory requirements.